12/22/2025: Freight Company Ordered to Pay $23 Million to Teamsters Trust Fund

Second Circuit reverses district court's denial of NLRB's injunction attempt.

There are two cases today, one in which the Second Circuit reverses a district court’s denial of the NLRB’s attempt to secure a preliminary injunction against a parking company that refused to hire union workers and one in which an Administrative Law Judge orders an employer to pay over $23 million to a Teamsters health and welfare benefit trust that the employer illegally stopped paying into in 2019.

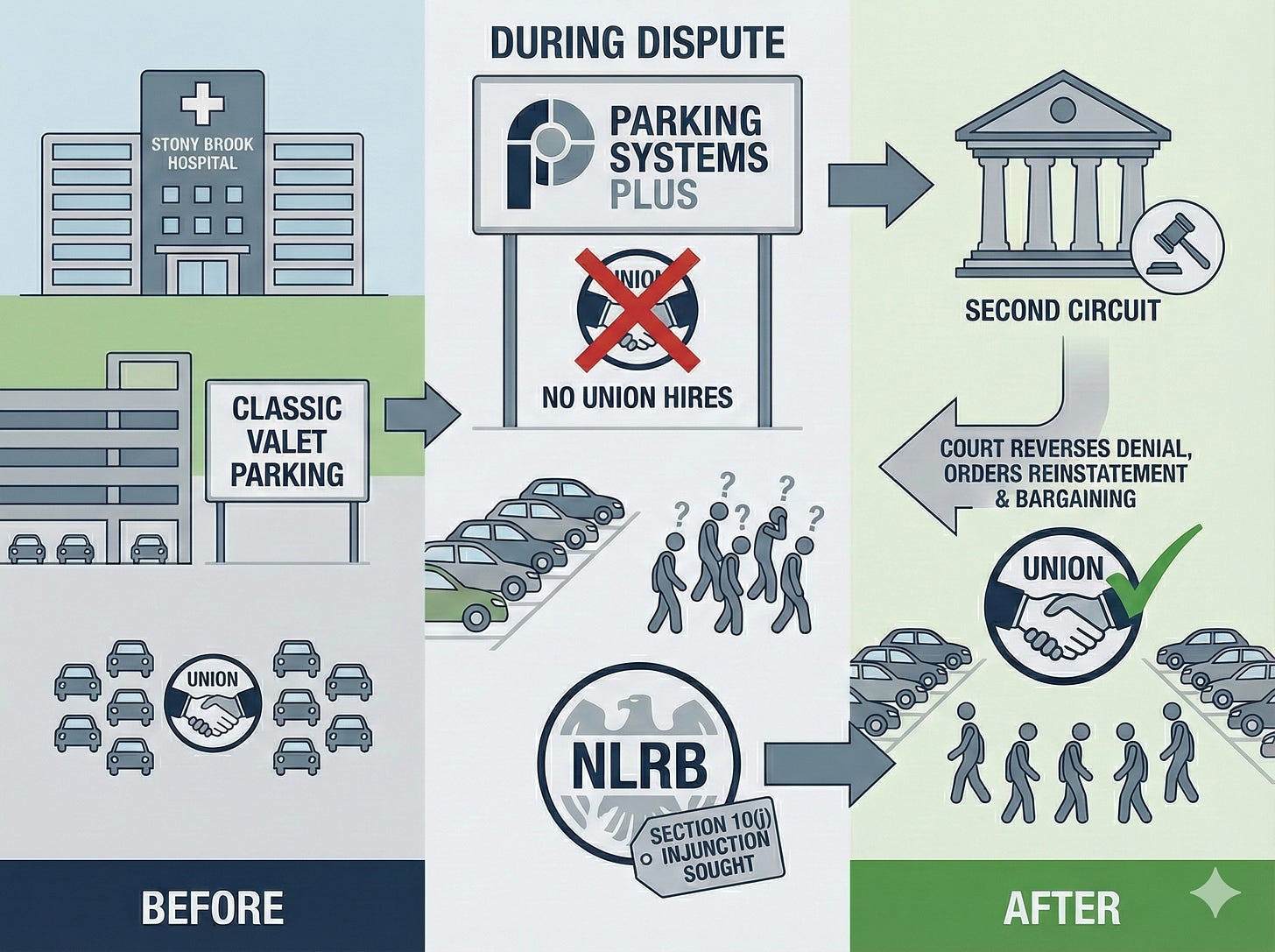

Poor v. Parking Systems Plus, Inc., 24-3324, (2nd Circuit)

The Second Circuit reversed a district court’s denial of preliminary injunctive relief sought by an NLRB Regional Director against Parking Systems Plus, finding the company likely violated federal labor law by refusing to hire unionized workers and failing to bargain with their union.

Parking Systems won a contract to provide valet parking at Stony Brook Hospital, replacing Classic Valet Parking, whose 34 employees were unionized. Initially, Parking Systems expressed interest in retaining Classic’s workers, but changed course after learning of their union status. Internal emails showed concerns about union wage rates, and the company hired none of the Classic employees despite posting urgent job openings. One employee testified that a company owner said Parking Systems wouldn’t hire the workers “because they worked with the Union.”

The district court denied the Section 10(j) injunction in a four-sentence order citing lack of irreparable harm and filing delays. The Second Circuit found this violated Rule 52(a)’s requirement for findings supporting injunctive decisions.

Applying the Winter standard—mandated by the Supreme Court’s McKinney decision—the appeals court found the NLRB likely to succeed on multiple claims. Under Wright Line, evidence showed anti-union animus in the refusal to hire. Under Burns and Fall River Dyeing successorship doctrine, Parking Systems was obligated to bargain because of substantial continuity between the employers’ operations—both provided the same valet services at the same location. The court presumed that absent discrimination, Parking Systems would have retained a majority of Classic’s unionized workforce.

The court also found Parking Systems violated Section 8(a)(5) by unilaterally setting employment terms without bargaining. Because this was a “perfectly clear” case where the successor would have retained the predecessor’s workforce absent discrimination, Parking Systems was bound by Classic’s collective bargaining agreement from the outset under NLRB v. Katz.

On irreparable harm, the court found Parking Systems’ actions damaged employee confidence in the union and undermined collective bargaining rights. A five-month filing delay didn’t preclude relief, and current Board vacancies preventing final orders made interim relief particularly important.

The balance of equities favored an injunction. While Parking Systems would need to displace current employees, wrongfully discharged employees’ rights take priority, and the injunction would only bind the company to the agreement until good-faith bargaining concluded.

The Second Circuit reversed and remanded with instructions to enter the injunction requiring Parking Systems to reinstate the former Classic employees, recognize the union, begin negotiations, and potentially rescind unilateral changes.

Significant Cases Cited

Starbucks Corp. v. McKinney, 602 U.S. 339 (2024): Held that the traditional four-part Winter test for preliminary injunctions applies to Section 10(j) petitions.

Winter v. Natural Resources Defense Council, Inc., 555 U.S. 7 (2008): Established the four-part test requiring likelihood of success on merits, irreparable harm, balance of equities, and public interest for preliminary injunctions.

Fall River Dyeing & Finishing Corp. v. NLRB, 482 U.S. 27 (1987): Set forth the “substantial continuity” test for determining whether a new employer is a legal successor obligated to bargain with the predecessor’s union.

NLRB v. Burns International Security Services, Inc., 406 U.S. 272 (1972): Established that successor employers must bargain with incumbent unions when there is substantial continuity and majority workforce retention.

Wright Line, 251 NLRB 1083 (1980): Created the burden-shifting framework for proving discriminatory motivation in unfair labor practice cases.

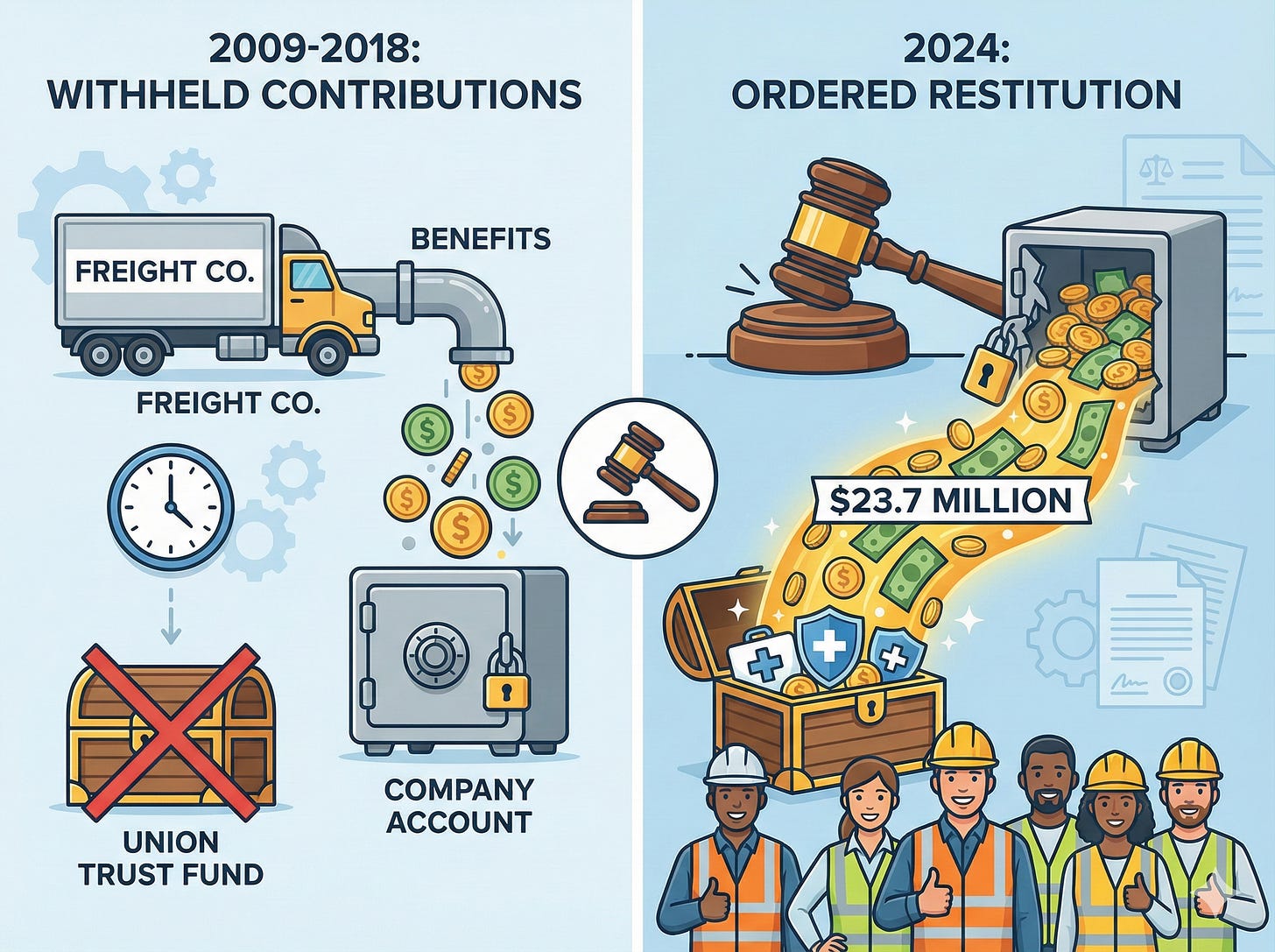

Oak Harbor Freight Lines, Inc., JD(SF)-22-25, 19-CA-031797 (ALJ Decision)

Administrative Law Judge Brian D. Gee ordered Oak Harbor Freight Lines to pay approximately $23.7 million to the Teamsters 206 Employers Trust for unlawfully withholding health and welfare benefit contributions over nearly a decade. The supplemental decision resolves a compliance proceeding stemming from the Board’s 2014 finding that the company violated Section 8(a)(5) of the National Labor Relations Act.

The underlying violation occurred in February 2009 when Oak Harbor unilaterally stopped making contributions to the multiemployer trust fund and instead implemented its own company health plan. After extensive litigation—including appeals to the D.C. Circuit and a petition to the Supreme Court—the Board’s order became final in February 2018, requiring Oak Harbor to restore employees to the trust and pay all delinquent contributions.

The compliance proceeding centered on calculating the amount owed during the make-whole period from February 2009 through December 2018, when Oak Harbor finally returned employees to the trust. The Region’s compliance specification alleged $19,735,261.12 in gross delinquent contributions and $3,947,052.21 in liquidated damages, plus interest.

Judge Gee adopted the Region’s calculation methodology, which multiplied the number of eligible employees by monthly contribution rates that increased over time to maintain benefits. The judge rejected Oak Harbor’s argument that contribution rates should have been frozen at 2007 levels, finding that the collective bargaining agreement and trust agreement contemplated rate increases necessary to maintain benefits. The decision noted that freezing rates would ignore the reality that contribution rates for all participating employers increased over time.

Oak Harbor raised numerous affirmative defenses, all of which the judge rejected. The company argued that the remedy constituted an improper windfall because employees lacked a concrete economic interest in the trust’s viability, particularly after the union disclaimed interest in October 2019. Judge Gee found that employees maintained concrete economic interests throughout the backpay period and beyond—current and future retirees continue accessing health benefits from the trust, and trust resolutions provide for retroactive benefit claims once back contributions are paid.

The company also contended that a February 2011 letter exchange between negotiators created an agreement limiting its liability to just two years. Judge Gee found no meeting of the minds occurred, noting the union’s letter explicitly reserved all rights regarding litigation remedies and that the parties merely agreed to maintain the company plan on an interim basis during ongoing negotiations.

Oak Harbor requested offsets for costs it incurred providing healthcare through its company plan or for hypothetical costs the trust would have incurred paying claims. The judge rejected these arguments, citing established Board precedent that employers cannot offset back contributions based on costs of unlawfully implemented substitute benefits or speculative trust expenditures.

Finally, the company raised a constitutional challenge based on SEC v. Jarkesy, arguing that the Seventh Amendment requires a jury trial for monetary remedies arising from contractual obligations. Judge Gee dismissed this defense, citing Supreme Court precedent that Board proceedings do not implicate the Seventh Amendment.

Significant Cases Cited

Phelps Dodge Corp. v. NLRB, 313 U.S. 177 (1941): Established that compliance remedies should restore the situation as nearly as possible to what would have existed but for the illegal discrimination.

NLRB v. Jones & Laughlin Steel Corp., 301 U.S. 1 (1937): Held that Board unfair labor practice proceedings do not implicate Seventh Amendment jury trial rights.

Performance Friction Corp., 335 NLRB 1117 (2001): Established that any backpay calculation formula is acceptable if it reasonably approximates what workers would have earned and is neither unreasonable nor arbitrary.

Triple A Fire Protection, 357 NLRB 693 (2011): Confirmed the standard remedy for unlawful discontinuation of trust fund contributions is to make employees whole by paying back contributions.

Stone Boat Yard v. NLRB, 715 F.2d 441 (9th Cir. 1983): Held that employers cannot offset back contributions based on costs incurred providing substitute fringe benefits, as they merely pay what was unlawfully withheld.